Apa itu Freight Forwarders?

Menurut situs GAFEKSI (Gabungan Forwarder & Ekspedisi Indonesia) atau INFA (Indonesian Forwarders Associations) -www.infa.or.id-; Jasa Ekspedisi Angkutan Barang (Freight Forwarding Services) merupakan jasa yang berhubungan dengan penerimaan, angkutan, pengkonsolidasian, penyimpanan, penyerahan, Logistik dan atau distribusi barang beserta jasa tambahan dan jasa pemberian nasehat yang terkait dengannya, termasuk kegiatan kepabeanan dan perpajakan, kewajiban pemberitahuan tentang barang untuk keperluan instansi pemerintah, penutupan asuransi barang dan pengutipan atau pembayaran tagihan atau dokumen yang berhubungan dengan barang tersebut.

Secara garis besar Freight Forwarding Services meliputi:

Ø Ocean freight forwarder / NVOC

Ø Air freight forwarder / air cargo agent

Ø Customs Agent

Ø Road haulier – Trucking

Ø In transit warehousing / Depot Opeartors

Ø Packing / Consolidating

Mengapa anda butuh Freight Forwarders’ Liability?

Freight Forwarders bertanggung jawab terhadap barang-barang pihak ketiga (cargo) yang berada dalam penanganan dan pengawasannya (care, custody and control) agar aman dan selamat samapi tujuan.

So Many Parties

Mengangkut barang dari satu lokasi ke lokasi lainnya diseluruh Indonesia (domestic) maupun diseluruh belahan bumi (worldwide) melibatkan banyak sekali pihak-pihak terkait mulai dari pemilik barang, sub-kontraktor, pihak angkutan darat, pihak pekerja bongkar muat, pelabuhan, pihak pelayaran, bea-cukai, dan pihak ketiga lainya. Jika terjadi klaim, siapa yang beratnggung jawab?

So Many Claims

Klaim dapat timbul dari kontrak pengangkutan, bill of lading atau airway bill, kontrak pergudangan, maupun tanggung gugat hukum pihak ketiga lainnya yang mungkin timbul dari suatu peristiwa kecekaan pengangkutan.

High Cost of Defence

Terbukti bertanggung jawab ataupun tidak, jika terjadi suatu permasalahan maka dapat dipastikan bahwa biaya investigasi dan pembelaan hukum bisa sangat mahal, biaya pengacara (lawyer) dan biaya-biaya pengadilan baik tingkat pertama, banding dan kasasi bisa sangat lama dan sangat mahal.

Freight Forwarders’ Liabilty Insurance sebenarnya adalah persyaratan wajib (compulsory) bagi perusahaan untuk bisa beroperasi di bidang jasa freight forwarders, namun demikian yang terjadi di Indonesia FFL belumlah merupakan keharusan terkecuali jika mereka dipersyaratkan dalam suatu kontrak atau keagenan dengan perusahaan asing.

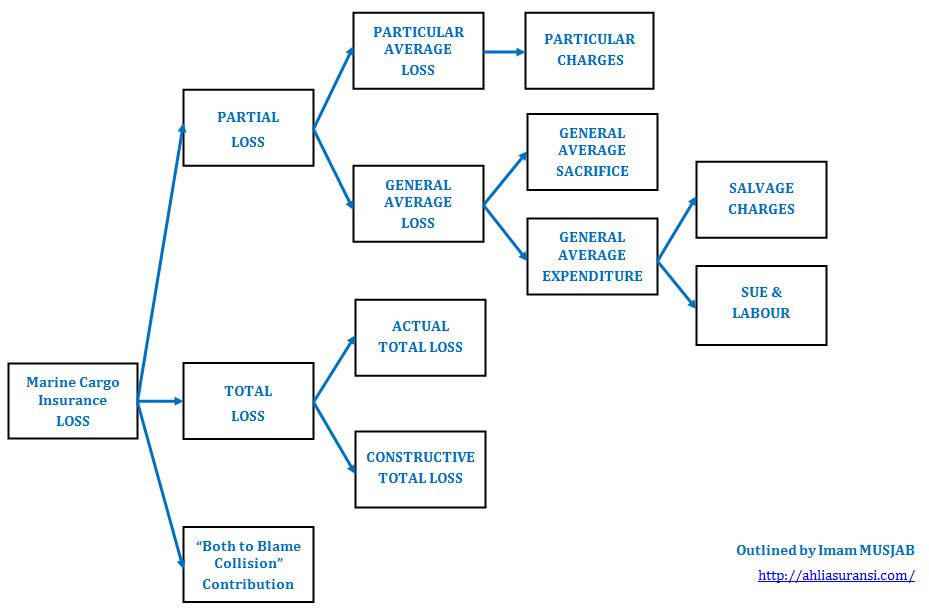

Bukankah sudah ada “Marine Cargo Insurance”?

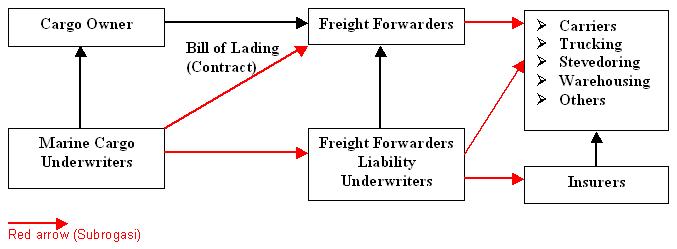

Marine Cargo Insurance dibeli dan premi dibayar oleh pemilik barang (cargo owner) untuk menjamin kerusakan atau kerugian yang terjadi pada kargo selama dalam perjalanan (transit), jika kerusakan atau kerugian kargo terjadi akibat dan berada dalam penanganan dan pengawasan (care, custody and control) Freight Forwarders, maka pemilik kargo maupun cargo underwriters akan menuntut hak subrogasi kepada perusahaan Freight Forwarders.

Kitab Undang-Undang Hukum Perdata (Pasal 1365 dan 1366)

Pasal 1365.

Tiap perbuatan yang melanggar hukum dan membawa kerugian kepada orang lain, mewajibkan orang yang karena salahnya menimbulkan kerugian itu untuk mengganti kerugian tersebut.

Pasal 1366.

Setiap orang bertanggung jawab, bukan hanya atas kerugian yang disebabkan perbuatan-perbuatannya, melainkan juga atas kerugian yang disebabkan kelalaian atau kurang hati-hatinya.

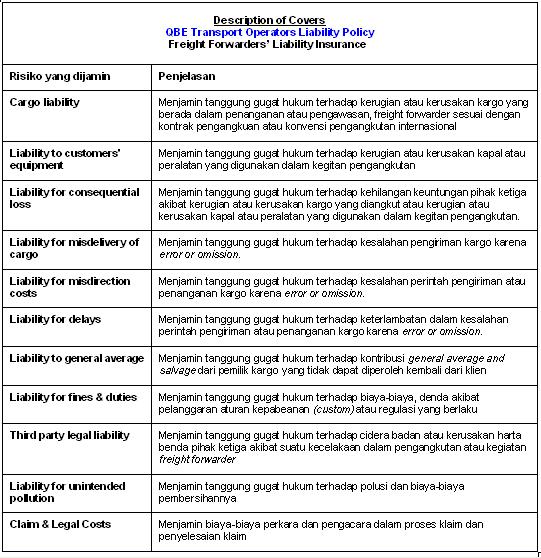

Apa yang dijamin dalam Freight Forwarders’ Liability?

Polis Freight Forwarders’ Liability Insurance memberikan jaminan yang lengkap untuk segala aktivitas jasa pengangkutan barang, tidak hanya terbatas pada jaminan atas kerugian dan kerusakan kargo tetapi juga menjamin consequential loss, misdelivery, delay, fines & duties, dan tentu saja jaminan terhadap third party legal liability, yang dibagi dalam 4 kelompok jaminan:

1) Cargo and Related Liabilities

2) Third Party Liability

3) Liability for Fines & Duty

4) Claims Expenses

1) Cargo and Related Liabilities

Menjamin tanggung gugat hukum terhadap kerugian atau kerusakan kargo yang berada dalam penanganan atau pengawasan, freight forwarder sesuai dengan kontrak pengangkuan atau konvensi pengangkutan internasional;

a. Kerusakan atau kerugian fisik pada kargo

b. Kerusakan atau kerugian fisik pada kapal atau peralatan pihak ketiga

c. Kerugian lanjutan atau biaya-biaya ekstra (direct consequential loss) sebagai akibat dari kerusakan atau kerugian a dan b

d. Kesalahan pengiriman, penyerahan kargo dan keterlambatan karena kelalaian dalam menjalankan SOP, (delay, incorrect or wrongful delivery of cargo, failure or omission to follow specific instruction)

e. Kontribusi biaya GA yang tidak bisa diperoleh dari klien (cargo’s contribution to general average and salvage which the Insured is unable to recover form the Customers)

2) Third Party Liability

Menjamin tanggung gugat hukum terhadap cidera badan atau kerusakan harta benda pihak ketiga akibat suatu kecelakaan dalam pengangkutan atau kegiatan freight forwarder

a. Cidera badan pihak ketiga (third party bodily injury)

b. Kerusakan atau kerugian harta benda pihak ketga (loss or damage to third party property)

c. Kerugian lanjutan atau biaya-biaya ekstra (direct consequential loss) yang diderita pihak ketiga sebagai akibat dari a dan b

3) Liability for Fines & Duty

Menjamin tanggung gugat hukum terhadap biaya-biaya, denda akibat pelanggaran aturan kepabeanan (custom) atau regulasi yang berlaku (Unintentional breach of any law or statutory provision) sehubungan dengan:

a. Export-import kargo

b. Peralatan (equipment) yang digunakan untuk pengankutan atau handling kargo

c. Keimigrasian (immigration)

d. K3 (safety of working conditions)

4) Claims Expenses

Menjamin biaya-biaya perkara dan pengacara dalam proses klaim dan penyelesaian klaim, biaya-biaya tsb dapat meliputi:

a. biaya-biaya surveyor, lawyer, or expert

b. biaya-biaya untuk memusnahkan kargo

c. biaya-biaya karantina, fumigasi, disinfektan (selain untuk prosedur normal)

Siapa saja yang bisa klaim kepada Freight Forwarders?

Jika terjadi kerusakan atau kerugian, Siapa saja yang bisa klaim kepada Freight Forwarders? Ya…bisa siapa saja. Klaim bisa datang dari:

Ø The cargo owner – your customer (Pemilik kargo)

Ø Sub-contractors

Ø Owners or operators of the vessel, aircraft or truck carrying the cargo

Ø Authorities (Pemerintah)

Ø Third parties to whom you owe a duty of care (Pihak ketiga)

Limit of Liability: Berapa jumlah ganti rugi nya?

Sesuai dengan Konvensi International yang dicantumkan dalam kontrak pengangkutan, Bill of Lading untuk pengangkutan laut dan Airway Bill untuk pengangkutan udara

Dalam hal pengangkutan kargo melalui laut, terdapat 4 konvensi internasional yang berlaku, yaitu:

Limits of Liability under the international conventions:

-

The limit under Hague Rules 1924 – Pounds 100 per package or unit, Pounds 100 being the amount to Pounds 100 gold value.

-

The limit under Hague-Visby Rules 1968 – 10,000 Poincare Francs per package or unit or 30 Poincare Francs per kilo of gross weight, whichever is higher

-

The limit under Hamburg Rules 1978 – 2.5 Special Drawing Rights (SDR) per kg or 835 SDRs per package or shipping unit

-

The limit under SDR Protocol 1979 – 2 SDRs per kg or 666.67 SDRs per package, whichever is higher

Sedangkan untuk pengangkutan udara diatur dalam Warsaw Convention 1929 – 250 French Gold Francs per kilogram (atau sekitar 51.9230 USD per kilogram)

Jika Berat Maksimum yang diperkenankan untuk container 20 Feet adalah 20 Ton dan untuk container 40 feet adalah 28 Ton dengan memakai SDR Protocol 1979 yang umum dipakai, dengan kurs 1 SDR = 1.53 USD maka akan diperoleh batas maksimum ganti rugi sebesar US$ 61,200 s/d US$ 85,680 per container.

Nah kalau dalam satu kapal terdapat 10 kontainer milik satu Perusahaan Freight Forwarders, maka perlu sedikitnya US$ 600,000 Limit of Liability per shipmentnyabukan? Belum lagi untuk menjamin extra charges dan Tanggung Jawab Hukum Pihak Ketiga dan Claim Expenses.

Special Limit Max US$ 100,000

Special Limit Max US$ 100,000 diberlakukan di polis khusus untuk cargo: (cigarettes, spirits or wines, works of art, mobile telephones and parts, computers and parts and software, memory chips, and computer security system).

Berapa Rate / Premi-nya?

Rate / Premi Freight Forwarders’ Liability sangat bergantung kepada besar kecilnya portfolio dan turn over perusahaan freight forwarders yang disebut Gross Freight Receipt (GFR), Company Profile, Range of Services, Claims Experience, and Limit of Liability.

Berdasarkan pengalaman biasanya premi mulai dari US$ 3,500 per tahun

*Gross Freight Receipt (GFR) is Gross revenue plus payments to agents and subcontractors in respect of transport services, but excluding customs duty, sales tax, or similar fiscal charges/ disbursements paid on behalf of customers. Do not deduct any cost of operation, fixed recurring or isolated overhead or any other expenses of any kind.

Bagaimana cara penutupannya?

Mudah saja anda tinggal telpon kami dan melengkapi:

1. Proposal Form

2. Company Profile

3. Bill of Lading / Airway Bill

Kami akan segera memberikan “Quotation” untuk anda pelajari dan mem-presentasi-kannya kepada klien.

Good Luck!!!

By: IMAM MUSJAB ! Telp: (021) 64701278 Ext 806

Hp: +628128079130 ! Email: imusjab@qbe.co.id

Website: http://ahliasuransi.com

*Source: www.qbe.com

*Picture: www.cargolaw.com

Artikel terkait:

Bill of Lading: What’s your “Paramount Clause”?

Quotation: Freight Forwarders Liability Insurance

Peluang dan Tantangan Berlakunya UU No. 17 Tahun 2008 Tentang Pelayaran

in services performed to the third parties (insured services)

in services performed to the third parties (insured services)